Phenoxyethanol Preservatives Market Analysis and Forecast (2024–2033)

Introduction

The global demand for safe and effective preservatives in personal care, pharmaceuticals, and industrial applications is experiencing rapid growth, with phenoxyethanol emerging as one of the most prominent solutions. Known for its strong antimicrobial properties and safety profile, phenoxyethanol is widely used as a preservative in cosmetics, personal care products, and pharmaceutical formulations. The market for phenoxyethanol preservatives is gaining momentum due to rising consumer preference for paraben-free products, increasing regulatory approval, and the growing global population's demand for hygiene and product shelf stability.

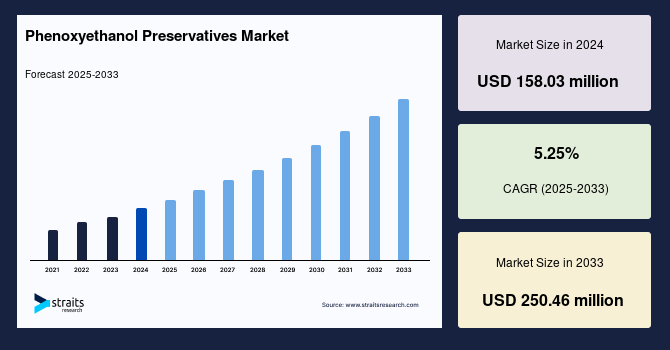

The global phenoxyethanol preservatives market size was valued at USD 158.03 million in 2024 and is projected to reach from USD 166.33 million in 2025 to USD 250.46 million by 2033, growing at a CAGR of 5.25% during the forecast period (2025-2033).

View report @ https://straitsresearch.com/re....port/phenoxyethanol-

Market Overview

Phenoxyethanol is a glycol ether often used to preserve products by preventing the growth of bacteria, fungi, and yeast. It is particularly favored for being effective at low concentrations and stable across a wide range of pH levels, making it ideal for use in a variety of formulations. In comparison to other synthetic preservatives, phenoxyethanol is considered safer and has less irritant potential, contributing to its wide adoption across industries.

The global phenoxyethanol preservatives market is projected to reach a significant valuation by the end of 2033, growing at a compound annual growth rate (CAGR) of approximately 5–6% during the forecast period. This growth is fueled by increasing demand in personal care, rising health awareness, and the shift toward clean-label formulations in cosmetics and healthcare.

Market Segmentation

By Type

Phenoxyethanol P5

This grade contains phenol levels ≤5 ppm and is the most commonly used variant in cosmetics and personal care applications due to its compliance with safety regulations in the EU and North America. It offers high purity and minimal irritation risk, making it suitable for skin-sensitive formulations.

Phenoxyethanol P25

With phenol content up to 25 ppm, this variant is more potent in terms of antimicrobial activity and is typically used in industrial applications, such as coatings, paints, and inks. It is also finding limited use in pharmaceutical preparations where higher preservative action is needed.

By Application

Cosmetics and Personal Care

The largest application segment for phenoxyethanol, accounting for more than half of the global demand. It is used in products like creams, lotions, sunscreens, makeup, shampoos, and baby care items. The rise of paraben-free product formulations and organic skincare trends are key growth drivers.

Pharmaceuticals

This segment is witnessing the fastest growth, especially in injectable and topical formulations. Phenoxyethanol's effectiveness in preserving sterility and extending shelf life is critical in maintaining pharmaceutical product integrity.

Dyes and Inks

The chemical's stability and solvency properties make it valuable in the production of inks and dyes, where it serves both as a solvent and a preservative. Growing industrial printing and packaging sectors are increasing demand in this space.

Home and Personal Hygiene

Products like sanitizers, surface disinfectants, and hand washes use phenoxyethanol for its broad-spectrum antimicrobial properties. Increased awareness of hygiene due to global health events continues to drive this segment.

Others (Paints, Adhesives, and Coatings)

The use of phenoxyethanol in industrial and construction products is gradually increasing, particularly in water-based paints and adhesives that require long shelf life and microbial stability.

Detailed segmentation Available @ https://straitsresearch.com/re....port/phenoxyethanol-/segmentation

Regional Insights

Asia-Pacific

Asia-Pacific dominates the phenoxyethanol preservatives market, driven by rapid industrialization, expanding middle-class populations, and growing cosmetics and pharmaceutical manufacturing hubs in countries like China, India, South Korea, and Japan. Government support for local manufacturing and increased consumer awareness are boosting demand.

North America

North America remains a strong and stable market due to stringent regulations that promote the use of safer preservatives. The U.S. and Canada have seen consistent growth in clean-label personal care products, which directly fuels phenoxyethanol demand. Innovation in product formulations by established cosmetic brands also plays a significant role.

Europe

Europe is an established market with a strong emphasis on quality, safety, and sustainability. The European Union imposes strict regulatory frameworks that limit harmful preservatives, thus encouraging the use of phenoxyethanol. High demand for organic and natural cosmetic products is also creating opportunities in the region.

Latin America and Middle East & Africa

These emerging markets are gradually increasing their use of phenoxyethanol, mainly in the cosmetics and hygiene sectors. Growth in disposable incomes, increasing awareness about hygiene, and expanding pharmaceutical sectors are contributing to the steady rise in demand.

Request a sample report @ hhttps://straitsresearch.com/re....port/phenoxyethanol-/request-sample

Market Drivers

Rising Consumer Awareness: A global shift toward personal health, wellness, and hygiene has encouraged consumers to seek safer and more transparent product ingredients, especially in skincare and pharmaceutical products.

Paraben-Free Trend: Growing scrutiny around the use of parabens has led manufacturers to replace them with safer preservatives like phenoxyethanol.

Regulatory Support: Regulatory agencies in the U.S., EU, and other regions permit the use of phenoxyethanol within certain concentration limits, which supports its widespread use.

Product Innovation: Companies are investing in new formulations using phenoxyethanol, including combinations with natural preservatives to meet the demands of eco-conscious consumers.

Challenges

Raw Material Price Volatility: Phenoxyethanol production relies on phenol and ethylene oxide, which are subject to price fluctuations due to supply chain disruptions and geopolitical tensions.

Stringent Regulations: Although allowed in many regions, the permissible levels of phenoxyethanol are strictly regulated. This requires constant monitoring and reformulation, which can increase production costs.

Rising Competition from Natural Preservatives: The growing trend toward natural and plant-based ingredients poses a competitive challenge to synthetic preservatives like phenoxyethanol.

Key Players

The phenoxyethanol preservatives market features a mix of global chemical manufacturers and specialty ingredient suppliers. Major players include:

Dow Inc.

BASF SE

Clariant AG

Lonza Group

Symrise AG

Galaxy Surfactants

Schülke & Mayr GmbH

Ashland Global Holdings Inc.

Akema Fine Chemicals

Thor Personal Care

These companies are focused on strategic expansions, mergers, and product innovations to strengthen their market position and respond to rising demand.

Having any query ask @ https://straitsresearch.com/bu....y-now/phenoxyethanol

Future Outlook

The phenoxyethanol preservatives market is expected to maintain a steady growth trajectory over the next decade. While consumer preference for natural products is increasing, the reliability, cost-effectiveness, and broad-spectrum antimicrobial activity of phenoxyethanol will continue to make it a preservative of choice across various sectors. Manufacturers investing in sustainable sourcing, green chemistry, and compliant formulations are likely to gain competitive advantage.

The shift toward cleaner beauty and healthcare, especially in high-growth regions such as Asia-Pacific and Latin America, presents substantial growth opportunities. However, industry players must remain responsive to evolving regulations and consumer expectations to sustain long-term growth.

About Us

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services, along with providing business insights & research reports.

Contact Us

Email: sales@straitsresearch.com

Website: https://straitsresearch.com

Like

Comment

Share